When you’ve been interested in dipping your toes into YNAB otherwise you’ve tried earlier than and it didn’t stick, this information will stroll you thru begin utilizing YNAB.

When you’ve been round right here for some time, you understand I really like speaking about techniques that make life simpler — meal planning, organizing the pantry, and sure… budgeting! One device that has actually reworked the way in which I take into consideration cash is YNAB (You Want A Funds). I’ve been utilizing it since 2016 and it has been LIFE altering! I’m so hooked on tinkering, learning, analyzing, and gazing at my funds. I’m at all times making an attempt to see if there are extra environment friendly methods to avoid wasting and spend.

I’ve additionally helped coach a handful of individuals with their YNAB budgets! Whereas the app isn’t onerous to make use of, there’s a little bit of a studying curve when wrapping your mind round the way it all suits collectively. Having somebody train you fingers on is the perfect approach to be taught.

Hearken to me on the YNAB Funds Nerds Podcast!

Why YNAB Works

In contrast to conventional budgets that really feel restrictive, YNAB is all about giving each single greenback a job. As a substitute of guessing what you would possibly spend sooner or later, YNAB works with the cash you have already got in your accounts proper now. It’s additionally extremely simple to maneuver cash between classes. So when you overspend on meals (me each month!) you need to use your buying cash to cowl that overage with two clicks.

The OTHER wonderful factor about it’s you could save on your “lumpy” bills like these stuff you would possibly pay quarterly, yearly or occasionally. For instance, placing $100 right into a Christmas class every month means you’ve gotten the money you want each Black Friday on your vacation buying. Or that automotive insurance coverage invoice you pay annually – save a bit of every month and also you magically have the complete quantity prepared when the invoice comes within the mail. Your funds shall be DIALED IN!

How To Begin Utilizing YNAB

Step 1: Signal Up and Join Your Accounts

- Head over to YNAB’s web site and begin your free 30-day trial (no bank card required). After that it’s $108 a yr.

- Join the checking, financial savings, and bank card accounts that you just use usually. I have a tendency to not add investments or bigger financial savings to maintain my funds easy. You’ll be able to nonetheless account for that cash despatched to an excellent place with out really seeing the balances. I focus totally on checking and bank cards.

- Consider your Plan as your digital money envelope system. After getting related all your checking accounts, you’ll have a big pile of cash in your Prepared To Assign.

Step 2: Assign Cash To Credit score Playing cards

In case you have bank cards (which most individuals do) and also you pay them off month-to-month, you’ll need to assign the quantity of {dollars} you assume your invoice shall be to the bank card funds space. So if in case you have $10,000 in Able to Assign and $2,000 at present in your bank card, transfer the $2,000 to your bank card, leaving the remaining $8,000 in Able to Assign on your spending and payments classes.

Step 3: Assign Cash To Financial savings

When you added any financial savings accounts to your YNAB, you may additionally need to transfer that cash to a saving class. The purpose right here to go away solely the cash you want from the month forward in your Able to Assign.

Step 4: Customise Classes (And Use Emojis!)

When you’ve moved the bank card, saving, and another reserved funds apart, it’s best to have a pile of cash to assign to classes. Earlier than you get to the enjoyable half, undergo YNAB’s default classes and customise them to your life!

In case you have a pet, create pet bills. In case you have youngsters, create child ones. In case your mobile phone is paid for by way of work, delete that class. Strive to think about EVERYTHING you spend on each within the month and all year long and create classes for them. Attempt to steadiness good monitoring with out creating so many who it’s inconceivable to seek out something.

Use emojis for the classes to make them extra enjoyable and straightforward to identify in your checklist!

Lastly, group classes in a approach that is smart to you. You could possibly do Month-to-month, Annual, Spending. Or Desires + Wants. Or Payments, Life-style, Family, Youngsters, and many others.

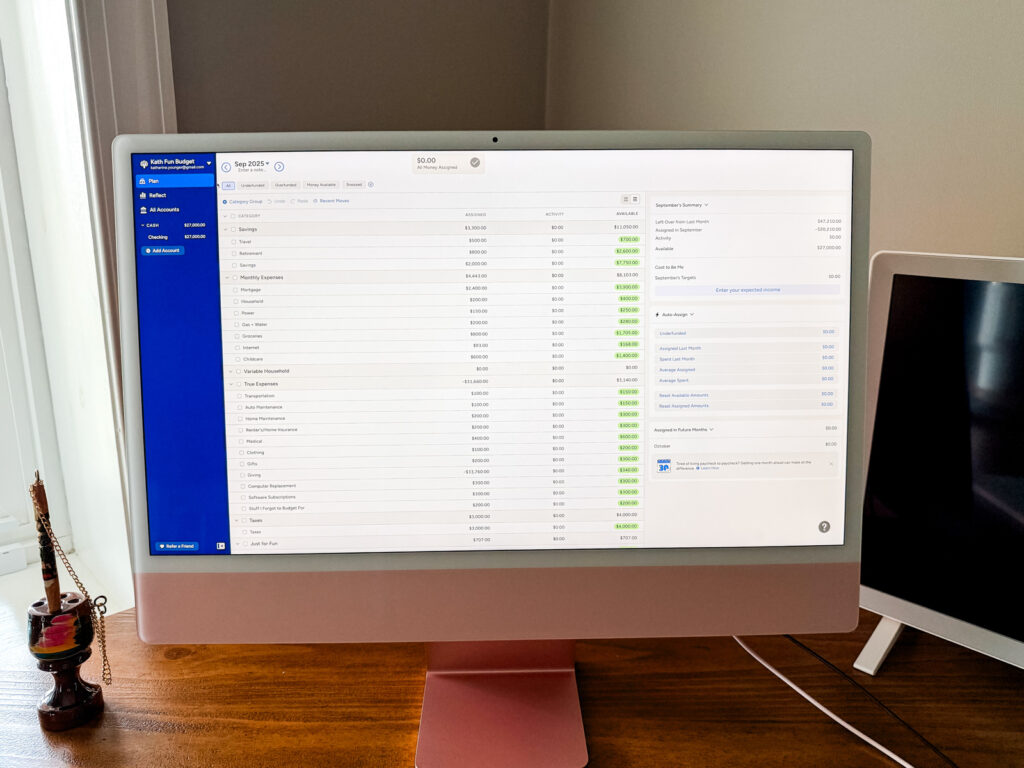

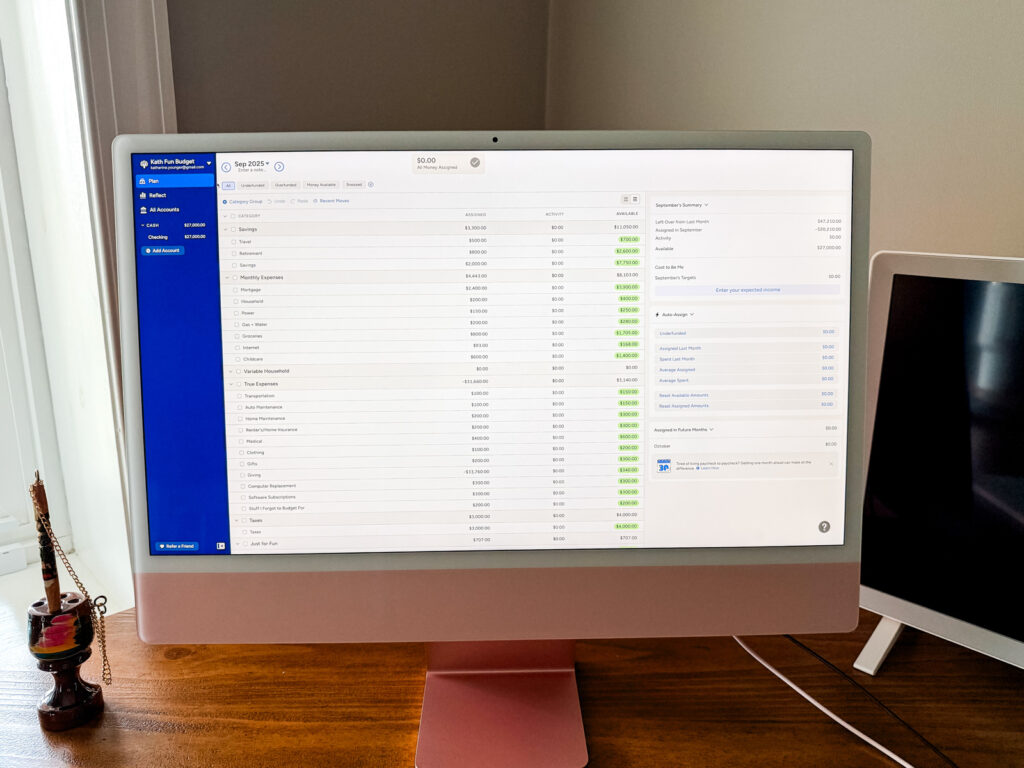

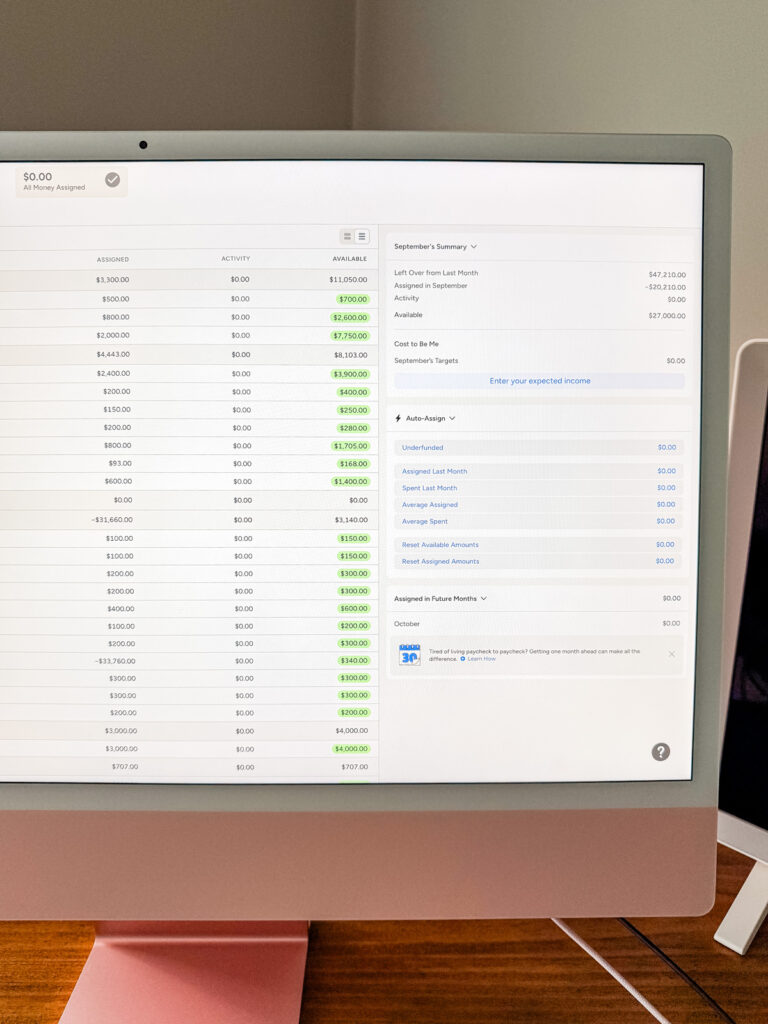

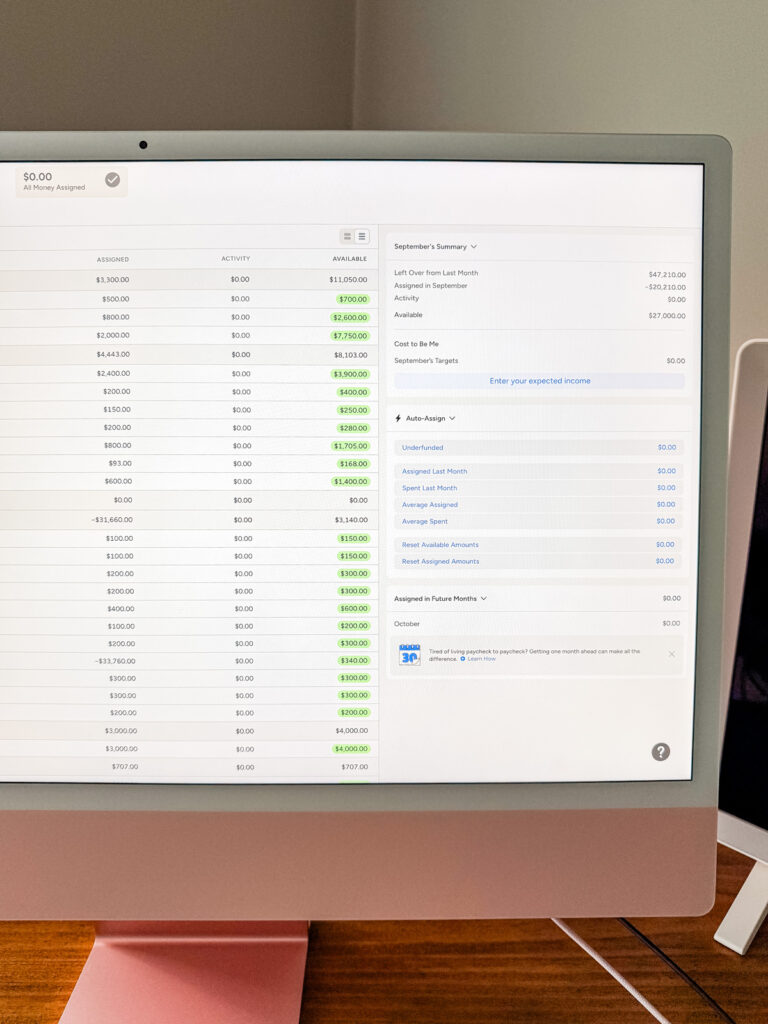

See all of my classes on this submit: My Funds Classes

Step 5: Contemplate Including Targets

Targets are discovered within the sidebar once you click on on a single class. The aim of a goal is to inform your plan how a lot you want for this class every month. As Ben and Ernie mentioned of their current Funds Nerds podcast, when you consider YNAB as a digital envelope system, what you assign to the class is the cash you set within the envelope. The goal is the amount of cash you need to begin every month with within the envelope!

For instance, $500 a month for eating out or $97 every month on your fitness center membership that get auto-debited. You don’t have to make use of targets, however they are going to assist you bear in mind how a lot every invoice is or your goal spending on every class that you just resolve. In addition they make budgeting SO quick as a result of you possibly can simply click on “underfunded” sooner or later and all of your targets will autofill!

Step 6: Give Each Greenback A Job!

Now’s essentially the most enjoyable a part of all! Utilizing the pile of cash in Able to Assign, begin divvying out all of the {dollars} you’ve gotten into your classes. You might need to reference your checking or bank card accounts to see what you often spend on issues. When you don’t know, simply ballpark and guess! You’ll be able to at all times transfer cash between classes if you have to.

Step 7: Get Absolutely Funded on the First

Hopefully you’ll get to the tip and nonetheless have a bit of left over, however when you don’t, which means you’ll have to construct up that buffer so that you might be absolutely funded on the primary. YNAB encourages you to dwell off final month’s earnings so that you don’t have to fret about timing your payments. This additionally creates a mini emergency fund of 1 month of bills buffer in your checking account. As I discussed above, you might need to maneuver some cash in from financial savings to do that otherwise you might need to work to avoid wasting a bit of every month till you’re a month forward. That is the large key to cease residing paycheck to paycheck. Finally, this may can help you spend this month with final month’s cash, which is when budgeting actually begins to really feel calm and empowering.

Step 8: Don’t Overlook Financial savings Classes

In YNAB, you deal with financial savings virtually like an expense. In case you have a recurring 401k switch, simply make that seem like an expense and when it debits, it leaves that class. In case you are planning a visit a yr from now, work out how a lot you assume you’ll want and attempt to put aside a bit of every month till you get there.

Step 9: Observe Spending as You Go

YNAB makes it simple to see what’s left in every class in actual time. You’ll be able to:

- Enter purchases on the cellular app proper at checkout.

- Or let your financial institution connection import transactions so that you can categorize later.

It’s actually essential to examine in in your funds as typically as attainable! Day by day is right, however don’t wait longer than each week or your transactions will pile up into a large number! It’s really easy to examine the app each morning and categorize and approve transactions. Make it part of your morning routine. Over time, you’ll begin to see patterns, spend extra deliberately, and really feel much less pressured about cash.

Give YNAB a strive!

Beginning a funds can really feel overwhelming, however YNAB makes it surprisingly approachable. Consider it much less like a strict weight loss plan and extra like meal planning — it provides you construction, freedom, and room for the stuff you love.

Put any questions you’ve gotten within the feedback!

Extra YNAB Posts: